Wednesday, 14 April 2021

Market Outlook - 14/04/2021

Monday, 8 February 2021

Data-Driven Approach To Cryptocurrency Speculation The Ultimate Methodology

Introduction

Fundamental Analysis

- The team reputation (e.g. team average age group)

- The team skill set composition (e.g. skill set balance, in marketing and engineering)

- The team skill set ratio (e.g. 70% engineers and 20% social community creation)

- The product white paper (e.g. well written whitepaper, reviewed by lawyer)

- HQ Location (e.g. London or Netherlands with stable legal framework etc.)

- Company partnerships (e.g. associates with other companies in the field )

- Social community size (e.g. 30.000 users in telegram channel)

- Technology Use Case:

- Payment

- Insurance

- Oracle

- Clean Energy

- Shopping

- Tokenomics (e.g. inflation, coin max supply, market-cap etc.)

- Code audit from the product:

- Security code audit from an independent 3rd Party (e.g. Review for security bugs etc.)

- Manual Audit (e.g. Review for code quality etc.)

- Github Repo code review (e.g. update frequency etc.)

Tools For Fundamental Analysis

- Coingecko - From this tool we can get information

- Lunarcrush - From this tool we can get information about the coin and social sentiment

- OpenZeppelin - From this tool we can get information about the security audits

Building Portfolio & Understanding Movement

- ETH has 0.74 to 0.96 correlation with BTC, which this translates to BTC is leading the way and ETH is following.

- LINK has 0.74 to 0.9 correlation with ETH, which this translates to ETH leading the way and LINK following.

- UNI has 0.76 to 0.88 correlation with COMP, which this translates to COMP is leading the way and UNI is following.

- SNX has 0.66 to 0.9 correlation with BTC, which this translates to BTC is leading the way and SNX is following.

On Chain Data And Technical Analysis

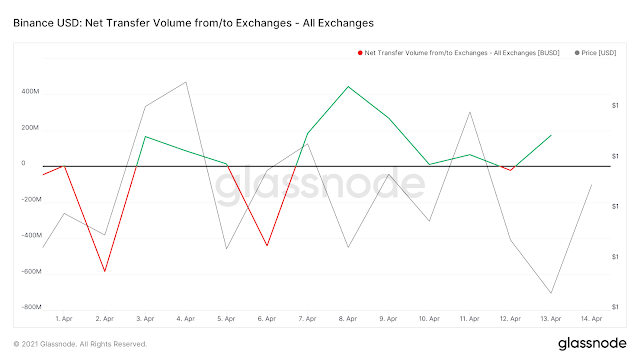

- Exchange Inflows/Outflows for swing trading from CryptoQuant and GlassNode

- Coin reserves on BTC and ETH for long term investment and swing trades from CryptoQuant and GlassNode

- NUPL indicator from GlassNode

- Stable coin reserves on all main exchanges from CryptoQuant and GlassNode

- Coin charts from Tradingview (for short term) and the following indicators:

- RSI with fibonacci values

- MACD with fibonacci values

- Moving Average, Weighted Moving Average for 21,34 and 13 days

- Buy and Sell walls from Tradinglight for short term movements

Bull and Bear Cycle Periods

When the graph hist 70% towards the BTC market, we switch to BTC, when it goes below 65% we switch to Alts and so on.

Technical Analysis

Social Media Sentiment

Summary/Last Words

- Step1: Fundamental analysis for long term is mandatory

- Step2: Crypto coin correlation can give us a good understanding about price movement

- Step3: On Chain data analysis is a must to get valuable insights

- Step4: Technical Analysis is a complementary tool

- Step5: Social sentiment can help you predict movement and new coins

- reddit [1]

Wednesday, 3 February 2021

ETH Price Evolution

Introduction

This blog post is going to make an assessment on the Ethereum price and attempt to predict how the ETH is going to perform the next three months, and when to exit. Since mid October 2020 there has been an insane accumulation of Bitcoin from Whales and since ETH has a 93% correlation with BTC, we can safely assume that ETH is going to go to the moon too. It does worth mentioning also that ETH the last year has outperformed BTC and it seems to have a certain type of "price decoupling". Which translates to an ETH movement that is going to ignore the indecisiveness of BTC and move to an ATH.

This is the BTC/ETH ratio daily chart created using Tradingview [7]:

Ethereum's out-performance looks set to endure also in the near term, as the BTC/ETH ratio breaks to its lowest levels since August of 2018. That being said, both cryptocurrencies seem poised to move higher in the coming weeks, as bullish technical setups take shape on multiple time-frames.

Article key points:

- ETH EIP-1559 burning mechanism

- ETH as a DeFi reserve

- ETH trend

- ETH price suppression

ETH Reserve

Based on coin-telegraph [1], analysts predict ETH may soon hit a new all-time high after ETH reserves on centralized exchanges fell by 27% in two days. The acceleration of ETH being taken off exchanges was highlighted by Nuggets News [2] Alex Saunders, who noted a 10% drop in Ether reserves on centralized platforms on Jan.14 — from 11 million to 10 million over 24 hours. “Exchanges will run out of ETH in 10 days at current rate,” he predicted.

This can also been seen on the Cryptoquant charts [3]:

In the chart above we see a rapid drop on Jan 23 and the then slower movements to further down. This is a strong indicator of a Storage of Value (SoV) asset. Long term HODLERs are going to benefit from just holding ETH.

ETH The Reserve Of DeFi

As far as blockchain is concerned, investors believe that ETH has a value storage function [4]. Below we can see the total ETH 2.0 value staked so far.

This can also been seen on the Cryptoquant charts [3]:

- Chain interoperability e.g. cross chain data exchanges

- Chain oracles e.g. see Chain-link technology

- Web 2.0 connectivity e.g., see API3 technology

ETH Is Burning

ETH Is On An Uptrend

ETH Is Suppressed By Whales

Conclusion

References

- cointelegraph [1]

- NuggetsNews/videos [2]

- Cryptoquant [3]

- tokeninsight.medium.com [4]

- decrypt.co [5]

- visualcapitalist [6]

- dailyfx [7]

- investopedia [8]

- investopedia [9]

- thebalance [10]

- hebergementwebs [11]

- github [12]

Saturday, 28 November 2020

Matic Netowk (MATIC) Analysis

Introduction

Matic Network has been a project on my radar for quite some time now, but one that I have never had the opportunity to spend any time properly researching. The article audience is intended to be technically savvy investors e.g. developers and Information Technology people.

For those who’d like to learn a little more about Matic Network prior to reading this report, here are some primary links:

This article might get updated, so stay tuned, and is meant to provide a holistic overview of Matic Network for readers, both old and new to Matic Network.

Fundamental Analysis/ Metrics

Name: Matic Network

Ticker: MATIC

Token Type: ERC-20

Validator Method: PoS

Platform: Ethereum blockchain only (currently)

Category: Mid cap

Transactions Per Second: up to 10,000 (internal test-net)

Note: As of 30/11/2020 Ethereum can only process on average about 14 transactions

Consensus Mechanism: Plasma + Proof of Stake (implemented in Bor component)

Sector (Use cases): Payments, Decentralized Exchanges, Gaming Networks

Exchanges: Link

Head Quarters (HQ): Bengaluru, Karnataka (India)

Number of employees: 61 employees (Linkedin - 28/Nov/2020)

Two year growth: 281% (Linkedin - 28/Nov/2020)

Company year founded: 2017

The company HQ is in India (not a big fun of India as a tech startup place). The most impressive part is that Matic Network has a growth, based on the Linkedin Insights Premium service, of 281%. The after mentioned percentage refers to the employee growth. The company started with 16 employees on Nov 2018 and reached 61 employees on Nov 2020.

The company employee ratio, based on specialty seems to be well balanced, see below:

Launch Overview

Token Economics

Token Staking

- Delegate Matic

- Run validator

- Lend Matic Network

Matic Partnerships

Social Media Presence

Technical Analysis

60 day trading volume from cryptometer:

Technology Overview

- Scalability: Fast, low-cost and secure transactions on Matic side-chains

- High Throughput: Achieved up to 10,000 TPS on a single side-chain on internal test-net

- User Experience: Smooth UX and developer abstraction from main-chain to Matic chain

- Security: Matic chain operators are themselves stakers in the PoS system

- Public Side-chains: Matic side-chains are public in nature (vs. individual DApp chains), permission-less and capable of supporting multiple protocols

Matic Network Wallet

Architecture Overview

- Heimdall

- Bor

- Contracts

Github Repository/Code Overview

Security Considerations

- $300 for Low findings

- $1500 for Medium findings

- $3000 for High findings

- $5000 for Critical findings

- Double spend by getting the clients to accept a different chain

- Double spend by validating malicious blocks

- Tamper/manipulate blockchain history to invalidate transactions

- Cause network to mint tokens to own account

- Undermine consensus mechanism to split the chain

- Censorship (e.g. on votes)

- Steal tokens from node

- Prevent node from accessing the network

- Abuse bugs in the economic system to defraud other participants (e.g. avoid transaction fees to full nodes)

- DDOS attack

- Chain halt and shutting down the network

- Go before 1.12.10 and 1.13.x before 1.13.1 allow HTTP Request Smuggling. - Medium

- The crypto/x509 package of Go before 1.10.6 and 1.11.x before 1.11.3 does not limit the amount of work performed for each chain verification, which might allow attackers to craft pathological inputs leading to a https://blog.bluzelle.com/layer-2-leader-matic-network-partners-with-bluzelle-to-provide-decentralized-data-storage-to-dapps-e9099011b1fbCPU denial of service. Go TLS servers accepting client certificates and TLS clients are affected. - High

- In Go before 1.10.6 and 1.11.x before 1.11.3, the "go get" command is vulnerable to remote code execution when executed with the -u flag and the import path of a malicious Go package, or a package that imports it directly or indirectly. - Critical

- Pivotal Spring AMQP, 1.x versions prior to 1.7.10 and 2.x versions prior to 2.0.6, expose a man-in-the-middle vulnerability due to lack of hostname validation. - Medium

- An issue was discovered in Pivotal RabbitMQ 3.x before 3.5.8 and 3.6.x before 3.6.6 and RabbitMQ for PCF 1.5.x before 1.5.20, 1.6.x before 1.6.12, and 1.7.x before 1.7.7. MQTT (MQ Telemetry Transport) connection authentication with a username/password pair succeeds if an existing username is provided but the password is omitted from the connection request. Connections that use TLS with a client-provided certificate are not affected. - Medium

- CRLF injection vulnerability in the management plugin in RabbitMQ 2.1.0 through 3.4.x before 3.4.1 allows remote attackers to inject arbitrary HTTP headers and conduct HTTP response splitting attacks via the download parameter to api/definitions. - Medium

- Cross-site scripting (XSS) vulnerability in the management plugin in RabbitMQ 2.1.0 through 3.4.x before 3.4.1 allows remote attackers to inject arbitrary web script or HTML via the path info to api/, which is not properly handled in an error message. - Medium

- RabbitMQ before 3.4.0 allows remote attackers to bypass the loopback_users restriction via a crafted X-Forwareded-For header. - Medium

Conclusion

- As far as their business/social presence is concerned from me gets an 9 out of 10. Well designed site, clear businesses goals, strong community, good partnerships.

- As far our their technology is concerned from me gets a 7 out of 10. Well documented technology good technologies adopted, easy to install software.

- As far as the token economics is concerned I will give it a 7 out of 10. The coin inflation is good.

- As far as the product information security posture is concerned, Matic Network demonstrates a healthy attitude, by participating in a well known bug bounty program. The code is publicly available and can be reviewed by anyone.

- Very well designed stacking mechanism and decent reward systems, this is a 9 out of 10 staking technology.

- As far as their business goals are concerned Matic Network is entering multiple high competitive markets such as payments, gaming and DEX(s), instead of focusing in only one or similar markets (e.g. DEX(s) and payments).

- Utilizing the Matic Network token for payments, makes it not good as a value for storage asset (e.g. using it as a currency for retail usage, suppresses the token value).

- The Matic Network wallet does not have a good rating in Google Play and it has not been updated since 2019.

- The technologies adapted from Matic Network, such as Go programming language, is relatively new and immature. This will later on translate to multiple functional and security bugs.

- https://matic.network/ [1]

- https://academy.ivanontech.com/blog/defi-deep-dive-what-is-matic-network [2]

- https://cryptorank.io/ico/matic-network [3]

- https://etherscan.io/token/0x7D1AfA7B718fb893dB30A3aBc0Cfc608AaCfeBB0 [4]

- https://decryptionary.com/dictionary/hard-cap/#:~:text=Hard%20cap%20is%20defined%20as,selling%20them%20directly%20to%20people.[5]

- https://www.cvedetails.com/vulnerability-list/vendor_id-14185/product_id-29205/version_id-280800/Golang-GO-1.11.0.html [6]

- https://www.cvedetails.com/vulnerability-list/vendor_id-15183/product_id-30922/version_id-179125/Pivotal-Software-Rabbitmq-3.3.5.html [7]

- https://hackerone.com/matic-network/?type=team [8]

- https://www.globenewswire.com/news-release/2020/07/29/2069530/0/en/Blockchain-Foundry-and-Matic-Network-Establish-Partnership-to-Research-Blockchain-Interoperability.html [9]

- https://blog.matic.network/matic-partners-with-ankr-network/ [10]

- https://blog.bluzelle.com/layer-2-leader-matic-network-partners-with-bluzelle-to-provide-decentralized-data-storage-to-dapps-e9099011b1fb [11]

- https://medium.com/razor-network/razor-network-partners-with-matic-network-af6521b6771f [12]

- https://medium.com/powerpool/powerpool-x-matic-network-partnership-cf52b7301cae [13]

- https://www.meter.io/meter-matic-partnership/ [14]

- https://www.ledgerinsights.com/india-blockchain-accelerator-partners-matic-harmony-aeternity/ [15]

- https://www.crowdfundinsider.com/2020/10/167986-defi-protocol-mantra-dao-partners-matic-network-an-ethereum-layer-2-blockchain-scalability-solution-provider/ [16]

- https://en.wikipedia.org/wiki/Go_(programming_language) [17]

- https://www.stakingrewards.com/earn/matic-network?fbclid=IwAR0WSyOR9IEXwq9_X7HujeAE8yMwu3emYKmPCvxPF5Ooq9upxisQi3ogvnM [18]

- https://blog.matic.network/staking-on-matic-network-mainnet-is-now-live-how-to-delegate-matic/ [19]

Market outlook 04-11-2021

Bitcoin Status The Bitcoin volume is not here yet, it seems that the retails is not "lured" yet in to the planned big "pump ...

-

Bitcoin Status The Bitcoin volume is not here yet, it seems that the retails is not "lured" yet in to the planned big "pump ...

-

Introduction The NFTify team following the popular narrative on NFTs created NFTify. This is an interesting token NFTify allows businesses...

-

Introduction This article is going to discuss the upgrades of ETHv1.0, more specifically meaning the ETHv1.x updates and how this is goin...