Monday 28 June 2021

Market Outlook - 28/06/2021 (Bitcoin Situation Part2)

Sunday 13 June 2021

Market Outlook - 13/06/2021 (Bitcoin Situation)

Introduction

The On-Chain Data (Mempool)

The On-Chain Data (Hash Rate)

The Conclusion

Note: There is a support line at 38. Which I think it will hold for now. Both RSI and MACD show a down trend, show time to accumulate more BTC.

Friday 4 June 2021

The Narratives & the Atlcoin Market

Introduction

- something that is narrated : STORY, ACCOUNT

- the representation in art of an event or story

- the technological them used to describe the problem that the currency is used to solve

Matic's is layer two Ethereum solution using side chain for performance reasons

The Market & The Narratives

Below we can see a schematic representation:

The narratives that came up in this bull market are the following:

Below we can see the definitions on some of the narratives:

Optimistic Rollups

Optimistic Rollups (ORs) are one type of layer 2 constructions that do not run on Ethereum's base layer but on top of it. This enables running smart contracts at scale while still being secured by Ethereum. These constructions resemble Plasma, but trade the almost infinite scalability of Plasma to run an EVM compatible Virtual Machine called OVM (Optimistic Virtual Machine) which enables ORs to run anything Ethereum can.

Plasma

Plasma is a layer-2 scaling solution that was originally proposed by Joseph Poon and Vitalik Buterin in their paper Plasma: Scalable Autonomous Smart Contracts. It is a framework for building scalable applications.

ZK-Rollups

ZK-Rollups are one of the options being developed for layer 2 construction that increases scalability through mass transfer processing rolled into a single transaction.

NFTs

An NFT is a digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.

DEX

A decentralised exchange (or DEX) is a peer-to-peer marketplace where transactions occur directly between crypto traders. DEXs fulfill one of crypto’s core possibilities: fostering financial transactions that aren’t officiated by banks, brokers, or any other intermediary. Many popular DEXs, like Uniswap and Sushiwap, run on the Ethereum blockchain.

As the market started evolving we started seeing combinations of the narratives:

Popular narratives

Narratives of the future

The narratives of the future are the narratives that emerge in order to solve new problems or optimise the solutions that currently exist even more. A few examples can be seen below:

How can you profit?

References:

- docs.ethhub.io [1]

Market Outlook - 04/06/2021 (Bitcoin Situation)

Introduction

The Basics

- Resources

- More capital

- Control of the media

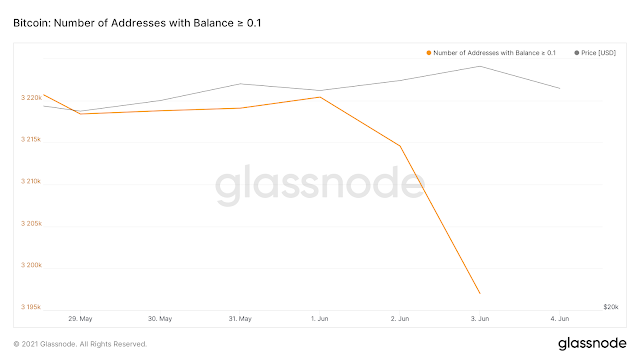

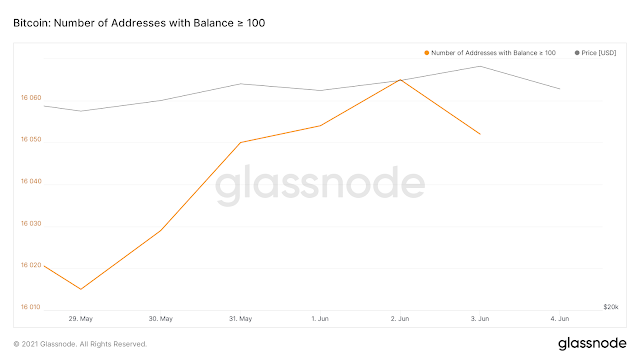

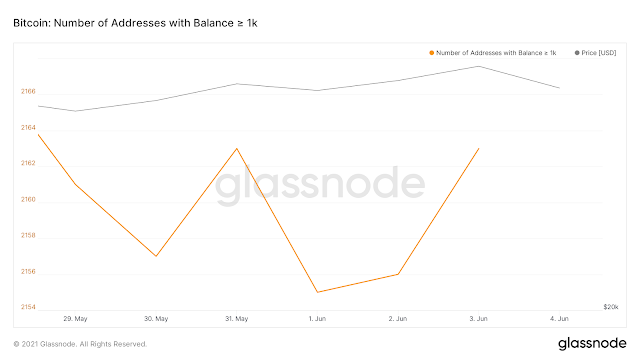

The Facts

What is OTC

Accumulation Phase

- Company earnings announcements

- Can be annual or every 4 months

- Company dividend announcements

- Can be annual or every 4 months

- Company tax returns (near the end of the year)

- investopedia.com [1]

- Tesla Info [2]

Market outlook 04-11-2021

Bitcoin Status The Bitcoin volume is not here yet, it seems that the retails is not "lured" yet in to the planned big "pump ...

-

Introduction This article is going to discuss the upgrades of ETHv1.0, more specifically meaning the ETHv1.x updates and how this is goin...

-

Introduction The Bitcoin market has seen a relatively quiet week, both in price action, and in demand for on-chain transactions and valu...

-

Introduction This article is going to focus on a few coins and run a basic analysis for opening trades. Below I am listing some interestin...