Introduction

In this blog post we are going to talk again about Bitcoin microscopic and macroscopic charts. As the probability for high Bitcoin market volatility increases, we

will analyse the current market situation using on-chain metrics and charts. Things started to look better already, but remember the trend is your friend and trade do not date.

I would also like to inform you that we started our new channel, so please feel free to pay us a visit:

Microscopic Outlook

As we can see in the chart below the Bitcoin dominance is increasing and retesting previous resitance line. The most inetersting patterns can be seen by the RSI trend reversal pattern. It looks like smart money are entering the market.

Note: Even though the volume remains low, we can clearly see that Bitcoin is slowly reclaiming dominance.

Below we can see the 3m Bitcoin mempool chart:

Note: Volatility is not here there compared to May, but we can see spikes. So Bitcoin constellation is still on the play.

On-chain

activity remains extremely muted with mempools clearing, and

transaction volumes continuing to fall. As the mempool empties, the

average block size has fallen by 15% to 20%, down to 1.103M bytes. [1]

Note: This indicates that demand for Bitcoin block-space and on-chain

settlement is low, mined blocks are not full, and the utilization of the

network is relatively low.

Below we can see the addresses holding more than 10K of BTC (two week chart):

Note: This chart information combined with the low volatility shows that the Bitcoin price is going to consolidate, for at least one more week. This chart also shows us that because most of the smart money buys through OTC, and because the addresses holding more than 10k increases and then drops, market manipulators want to slowly increase the Bitcoin price. This is also called the accumulation phase.

Below we can see the Bitcoin annual exchange reserves:

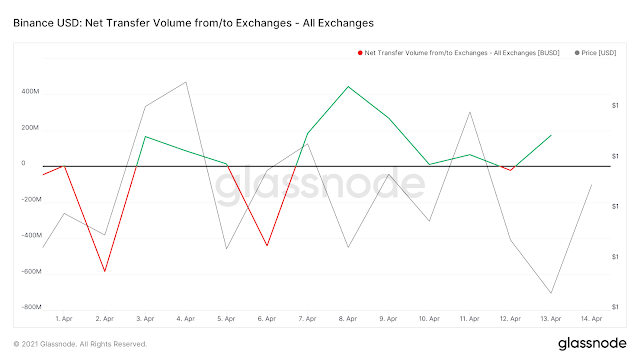

Below we can see the exchange net flows of BTC (two week chart):

Note: This charts confirms previous conclusion, which are a) BTC hit bottom, b) accumulation started. We can see the pattern designates small increments of the smart money in the BTC cap.

Macroscopic Outlook

We do not have nuch to say about the Bitcoin macros. The most important news about Bitcoin is that high net-worth individuals are buying in:

Cathy Woods bought Bitcoin recently (this verifies accumulation started):

Rothchilds bought Bitcoin recently (this verifies accumulation started):

Conclusion

The following conclusions are confirmed:

- Net Entity growth remains positive

- Exchanges have seen net outflows after an extended period of inflows since mid-May.

- Smart Money started pouring in

- It looks like accumulation started.

References: