Introduction

This post hopefully is going to remove some of your FUD and help you understand what is going on in the market right now. I am going to explain some basic principles of the market and dive into my view backed with FACTS and it will all make sense. A lot of YouTube and Twitter influencers keep on saying that BTC is dropping because Elon is posting his ridiculous twitter posts WRONG, this might help the drop of BTC but is not the main reason.

The Basics

Market prices are affected by various facts. The market is mainly driven by supply and demand (small supply usually creates demand and vise versa). In crypto we have more visibility, on what is happening, due to the on chain data. Stock and crypto prices are determined in the marketplace, where seller supply meets buyer demand.

Below we can see how FUD and FOMO are triggered:

FUD and FOMO are triggered by information. Information that is 90% manipulated and controlled by the Whales.

That is correct Whales have:

- Resources

- More capital

- Control of the media

Retail investors control nothing, ONLY THEIR EMOTIONS TO NOT BUY AND HOLD OR TO SELL THE RIGHT TIME.

The Facts

What are the facts, the facts are that whales do not care about your financial freedom, but they care for making profit.

Below we can see the 7 day number of Addresses with Balance ≥ 0.01 (this is the retail):

Note: As we can see this is dropping relatively slow.

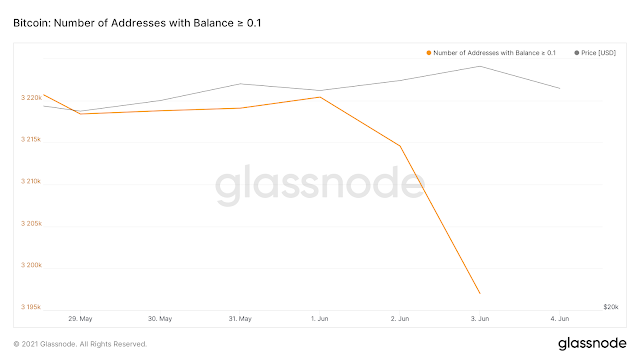

Below we can see the 7 day number of Addresses with Balance ≥ 0.1 (this is still the retail):

Note: As we can see again this is dropping relatively fast.

Below we can see the 7 day number of Addresses with Balance ≥ 1 (this is still the retail):

Note: As we can see again again this is dropping relatively fast (same curve as above).

Below we can see the 7 day number of Addresses with Balance ≥ 10 (this is not retail):

Note: As we can see curve is changing as the the number of addresses is fluctuating, and is not a straight line dropping.

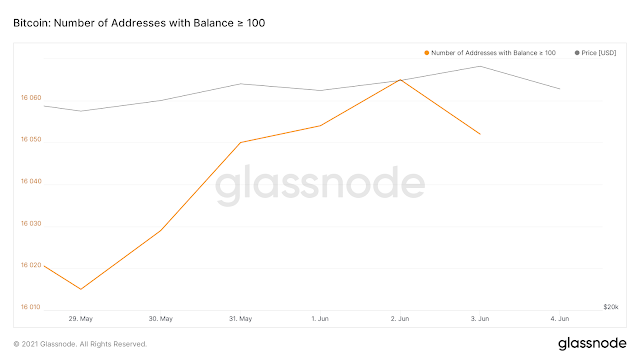

Below we can see the 7 day number of Addresses with Balance ≥ 100 (this is not, obviously retail):

Note: As we can see the trend is changing slowly.

Note: As we can see here is were the manipulation takes place. The wales sell and buy BTC in order to maintain the price close to 35k.

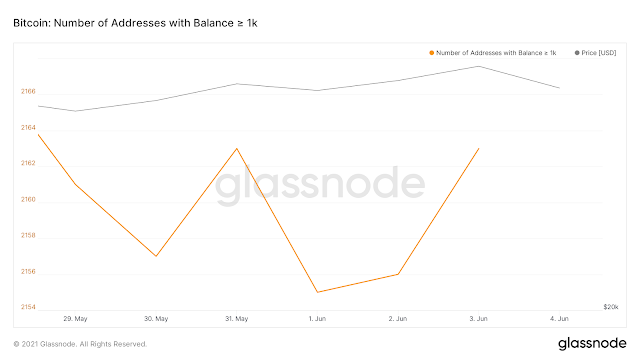

Below we can see a schematic representation of the address movement:

Note: When the addresses move up and down BTC will consolidate. Whales are currently on vacation or waiting for the next accumulation cycle.

What is OTC

Over-the-counter (OTC) refers to the process of how securities and Bitcoin are traded via a broker-dealer network as opposed to on a centralised exchange. Over-the-counter trading can involve equities, debt instruments, and derivatives, which are financial contracts that derive their value from an underlying asset such as a commodity.

In simple words OTC does not affect the BTC price. Below we can see the OTC/CEX buy history ration for a whale:

<<< Whales accumulate only through OTC and Retail investors only through CEXs.>>>

Accumulation Phase

When did them accumulation started? 8th of Feb see below:

Note: We can see above that the addresses picked on 8th if Feb and we reached ATH on 22nd of Feb. And the addresses started droping gradually, until now.

This means that when a second accumulation starts the BTC price will start increasing again. When accumulations start and stop?? Well it depends on how BTC is used. Recently companies started including BTC in their balance sheets for cash replacement. This means that important company dates related to a company profitability are important for the BTC accumulation start and stop dates.

The following events will help us assess the start of the new accumulation:

- Company earnings announcements

- Can be annual or every 4 months

- Company dividend announcements

- Can be annual or every 4 months

- Company tax returns (near the end of the year)

An earnings announcement is an official public statement of a company's profitability for a specific period, typically a quarter or a year. An earnings announcement occurs on a specific date during earnings season and is preceded by earnings estimates issued by equity analysts. If a company has been profitable leading up to the announcement, its share price will usually increase up to and slightly after the information is released. Because earnings announcements can have such a prominent effect on the market, they are often considered when predicting the next day's open [1].

Below we can see the TESLA earning announcements:

Note: We can see that TESLA earning announcement were reported on Q21 aka April 2021 and TESLA bought at 35K BEFORE THE ANNOUNCEMENTS. TESLA STOCKS WERE NOT AFFECTED BY THE BTC DROP. BTC LOST NO MONEY (ON PAPER FOR BUYING BTC). TESLA BOUGHT BTC IN THE CURRENT PRICE AND THE PRICE DID NOT DROP FOR A LONG PERIOD OF TIME BELOW 35K. ON Q2 2021 TESLA MIGHT SO PROFITS FROM OTHER RESOURCES/INCOMES. IT DOES NOT MEAN BTC WILL INCREASE ON Q3 FOR TESLA COMPANY, BUT THE COMPANY WILL LOOK GOOD IF BTC PRICE IS CLOSE TO 4OK BY END OF Q2 2021.

Below we can see when Elon started FUDing about BTC:

Below we can see when TESLA bought and what happened afterwards:

I leave the conclusions to you guys......

BTC market is increasing and therefore, it gets harder to manipulate. Also the BTC returns will minimise as time is passing by....................

References:

- investopedia.com [1]

- Tesla Info [2]

No comments:

Post a Comment