Introduction

This article is going to focus on a few coins and run a basic analysis for opening trades. Below I am listing some interesting coins that look promising for short term trading.

Bitcoin

Below we can see the 4hr Tradingview chart:

Note: BTC seems is going to consolidate the next couple of weeks.

Below we can see the day Tradingview chart:

Note: We can see that BTC volume drops, MACD and RSI show a minor trend cool down. My speculation is that BTC will go side ways for the next couple of weeks, unless something big happens.

Below we can see the Glassnode BTC Exchange 2 week NETflow:

Note: The inflow seem to to increase, which conform a BTC consolidation.

Below we can see the Glassnode BTC Exchange 2 week reserve:

Note: It looks like the downtrend will continue, which is good as a macroscopic indecator.

Zilliqua (ZIL)

Below we can see the 4hr Tradingview chart:

Note: Volume reduced , RSI and MACD shows a reversal.

Below we can see the day Tradingview chart:

Note: Volume reduced , RSI and MACD shows a reversal. Strong support at 0.14677 dollars.

Uniswap (UNI)

Below we can see the 4hr Tradingview chart:

Note: It looks like Uniswap is preparing to make a significant move in the next days. Uniswap is forming a pennant! and volume pattern supports that.

Below we can see clearly the pattern:

Note: In technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a token, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the flagpole.

Below we can see the day Tradingview chart:

Note: This chart confirms the imminent upwards move. This is a even now a good entry point.

Below we can see the Glassnode Uniswap Exchange 2 week NETflow:

Note: It seems that Uniswap exchanges outflow are about to increase.

Below we can see the Glassnode Uniswap Exchange 2 week reserve:

Note: It seems that Uniswap exchanges balance is dropping and this info combined with the Unipig (Uniswap v3 upgrade) update is going to give a boost to the coin. This chart confirms the upwards move for UNI too!!

Binance Coin (BNB)

Below we can see the day Tradingview chart:

Note: This chart demonstrates that BNB is now in a price discovery move after hitting ATH. Just bare in mind that BNB has a 90% plus correlation with BTC, even though it is a utility coin and a fork of ETH Binance proved that can and will deliver (compared to ETH). Also this combined with the staking options provided and the burning features makes is a good candidate for hitting 1000 dollars by end of year if not more!!! Bare in mind that BNB Market Cap hit $88,350,515,767 and 100b is a psychological level.....

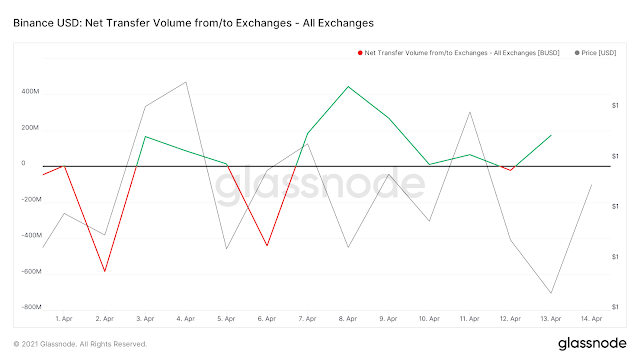

Below we can see the Glassnode BNB Exchange 2 week NETflow:

Note: The exchange netflow shows that it might be an inflow on the immediate future , if this continues will affect negatively the price.

Below we can see the Glassnode BNB Exchange 1 month reserve:

Note: This chart shows that the BNB reserves for the last month increased and this might actually have an negative impact on the price, that might cause BNB to consolidate.

LoopringCoin (LRC)

Below we can see the day Tradingview chart:

Note: LRC looks good baby. LRC is using zkRollup and is an Exchange and Payment Protocol. Loopring protocol can settle up to 2,025 trades per second while guaranteeing the same level of security as the underlying Ethereum blockchain. This is made possible by using a construction called zkRollup, which aggregates and executes transactions off-chain, in a provably correct manner. This is also a layer 2 solution that competes with ETH FYI. The longer the ETH waits for the upgrades, the longer LRC is going to boost. Both oscillators show an uptrend.

Below we can see the Glassnode Loopring Exchange 2w Netflow:

Note: Whales seem to withdraw from Loopring and this is good for the price.

Below we can see the Glassnode Loopring Exchange 1 month reserve:

Note: Reserve goes up and might not be good.

Matic Network or Polygon (MATIC)

Below we can see the day Tradingview chart:

Note: Matic, another layer 2 solution solving the congestion problem with ETH seems to do good, although my view point is that it is going to consolidate for while , untill see some big move.

Below we can see the Glassnode Loopring Exchange 1m Netflow:

Note: This chart shows as the MATIC is either going to wither consolidate for while or even drop its price.

Below we can see the Glassnode MATIC Exchange 1 month reserve:

Note: The monthly MATIC reserve drops and this is good as a microeconomics indicator. Although in the short term I would not wait for a significant move. It seems that MATIC is in an accumulation phase right now.

Below we can see the Glassnode MATIC staking 1 month chart:

Note: Microscopically speaking the chart above shows that whales and retail are moving their MATIC out of staking and into the exchanges, which designates some serious price action move. Meaning that people either move to other altcoins or actively trade MATIC. This smells accumulation!!!