Introduction

This blog post is going to make an assessment on the bitcoin price and attempt to predict how the BTC is going to perform the next three months. Since mid October 2020 there has been an insane accumulation of Bitcoin from Whales.

BTC accumulation

In the image below we can see the accumulation from May 2020 (10k > BTC accumulation) [1]:

As we can see the accumulation becomes massive after November 2020 and climaxes on December 2020, were BTC ATH is achieved. Now the diagram above includes all accumulations starting from 10k plus and therefore it should be very clear that the accumulation that takes place is related to institutional entities buying large quantities and not retail investors.

In the image below we can see the accumulation on December 2020 (10k > BTC accumulation) [1]:

Above the chart demonstrates that December accumulation becomes stronger with small gaps. My assumption is that, when the BTC was going sideways (which was happening for weeks) the whales stopped accumulating and used multiple buy/sell orders to stabilize the price using bots.

To be more specific, my opinion is that there are three types of buyers:

- Large institutions e.g. financial institutions.

- Wealthy accumulators e.g. treating BTC as value storage asset.

- Retail investors e.g. treating BTC as value storage asset.

The types of players that manipulate the price is the infamous "Whales" aka. the large institutions. Because the BTC market is relativity small (gold is $9 trillion and the SPDR S&P 500 ETF only is $316,359,000.00) financial institutions can relatively easy with small amounts decrease/increase the BTC price. The wealthy accumulators do play a significant role to the increase of the buy pressure, but they also seem to not accumulate BTC directly from the exchanges (e.g. accumulate from the miners directly etc.)

In the image below we can see the accumulation on December 2020 from 0.1 to 10 BTC [1]:

Above the chart demonstrates that the accumulation from retail investors is steady and smooth, since May 2020, with slight increases. If the retail investors were defining the BTC price, there would not be any strange movements, the price would have progressed naturally.

BTC exchange reserves

In the first part we talked about the fact that Whale accumulation increased dramatically, but we did not talk at all about the exchange reserves. Exchange reserves are not affected directly with "Over-the-counter" (OTC) BTC trading. My assumption is that despite BTC trading near all-time highs, more institutions continue and will continue to buy BTC using OTC trading firms to keep their purchases from impacting the overall market. The only reason for Whales to buy through OTC is pure price manipulation and nothing else. On the other hand wealthy individuals seems that also look into OTC trading for long term accumulation too.

Below we can see the rapid reduction of the BTC reserves in the Cryptoquant daily chart:

Below we can see the rapid reduction of the BTC reserves in the Cryptoquant hourly chart:

Above we can see a massive drop of the exchange reserves, we can also conclude that this demonstrates a very long term bull market.

Below we can see the rapid reduction of the BTC reserves compared to ETH reserves in the Cryptoquant daily chart:

Note: It does also worth mentioning that ETH has a 93% correlation with BTC and it seems that ETH price is much more suppressed than BTC. Also ETH price has not reached ATH yet and we can easily conclude that its price is more predictable.

BTC Price prediction

Below the chart shows the BTC realized price (shows the average price of all unspent bitcoins) were bought for and the MVRV indicator. Refer to Coinmetric's article for more details on MVRV. MVRV is bitcoin price/realized price. When MVRV is more than 1, bitcoin's price is undervalued.

The above diagram shows that for 2020 only March was the month that BTC was considered as undervalued. The type of investors/traders that can analyse this type of information and act in real time is mostly Whales. Also March of 2020, was a very good benchmark for BTC, that did not go unnoticed by many institutions. BTC and gold are a few of the assets that managed to bounce back very fast, during the COVID-19 pandemic. It is not luck that Micro Strategy that specializes in data analytics, started buying BTC like crazy.

Below we can confirm the analysis above, by having a look in the Binance Order Book Data. The yellow lines are places where whales have placed large orders, source is from TradingLight .

In the short term, it looks like there is a high chance that BTC will continue to consolidate or have two to three more major corrections, until March 2021. Retail investors are very active, but the whales are moving in ways that aren’t helpful to keep bitcoin rising.

Day traders should realize that markets are currently overheated. Markets have moved up investment has made markets dangerous. On the other hand, buying BTC as a long term investment to hold until next year now seems like a good decision. BTC, in the middle of next year, will surpass $30,000, according my calculations.

The previous chart is also confirmed from the trade pattern analysis provided by Cryptometer [3]. Cryptometer give us access to pattern analysis data, through their API service. Below we can see large numbers of transactions with fixed quantity, executed on multiple exchanges.

Exchange Inflow/Outflow

Below we can see the from CryptoQuant a chart that shows the mean inflow from four plus exchanges:

The mean inflow essentially shows that when it was increased on March 2020 the price dropped to ATL for 2020. This means that the top players and later on, the retail investors transferred money to their exchange wallets to sell BTC and therefore the inflow mean increased.

The mean outflow essentially shows that when it started decreasing after 18th of November 2020 the price started increasing to ATH for 2020. This means that the whales expect prices to rise, and they withdraw from exchanges in large amounts as they don’t need to trade and prefer to hold bitcoin in non-custodial, safe wallets. This can help us conclude that there is an opposite correlation between outflow mean and BTC price. Below we can see the hourly outflow mean.

Note: Above we can see some mean outflow spikes that clearly affect the BTC price negatively.

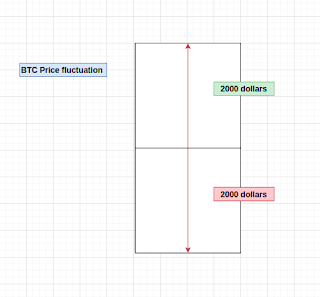

BTC price range

After careful observation using trading view diagrams we can see that BTC price is fluctuating in a range of 2000 dollars. Below we can see a weekly chart.

It seems that BTC in the weekly chart created some relatively strong support lines in:

- 19187.83 dollars (Support line)

- 18193.82 dollars (Support line)

- 15907.63 dollars (Support line)

- 13720.82 dollars (Support line)

Below we can see a day chart:

We can see that the support lines from the weekly chart, can be confirmed also by the day chart.

Conclusion

The BTC bull rally of 2020, has nothing to do with the 2017 bubble. BTC is widely accepted as storage of value asset. I am under the impression that the Whales are just postponing the price increase of the BTC and are not interested on suppressing the value for the long run. The BTC price is going to continue increasing until the end of 2021 and the most benefited are the BTC holders. Trying to scalp BTC simply does not make sense. BTC estimated price would be 30000 dollars plus.

This is a visualization of the price:

References:

- Whales Map [1]

- CryptoQuant [2]

- Cryptometer [3]